The big news from Infineon Technologies this month was the announcement of its 300-mm gallium nitride (GaN) wafer technology using existing silicon manufacturing production lines. In a roundtable briefing this week at Infineon’s headquarters at Campeon, Germany (near Munich), the company told a group of trade media that this was a “game changing” achievement and that customers were already “pulling on us to learn more” in terms of its impact for AI applications.

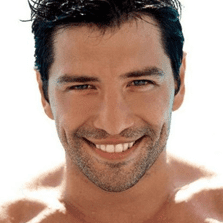

In the briefing, CEO Jochen Hanebeck and division president for power and sensor systems Adam White re-enforced the messages at launch (see “Infineon Advances GaN Technology with 300 mm Wafer Production”), referring it back to the broader decarbonization and digitalization themes that drive the company’s strategy.

This also gave us an opportunity to talk more in-depth with Hanebeck about more of the long-term opportunities, trends and challenges. As someone who’s been with the company throughout his 30-year career, from starting as a DRAM development engineer in 1994 (which was with Siemens and its joint venture with IBM and Toshiba) to becoming CEO in 2022, when Hanebeck talks, you witness an air of confidence based on solid engineering and domain experience combined with competent management oversight.

For example, when talking about chip manufacturing policy, he suggests that Europe will need a new Chips Act. “It’s not about a one-time spend of money [on manufacturing capacity],” he said. “I would stress that in the next iteration, it also needs to be around research and development and innovation.”

Hanebeck said that innovative ideas would, of course, be generated around clusters such as Dresden. “I would like to continue to attract factories but also move on the R&D.”

When we speak to management executives at leading firms in the industry, they invariably emphasize the global nature of the semiconductor and electronics manufacturing ecosystem, and Hanebeck echoed this. “No country in the world will achieve self-sufficiency,” he said. He added that his recommendation to the European Commission would be to strengthen the strengths we already have. “Critical areas of expertise will include technicians and maintenance, so we are [also] focused on vocational apprenticeships.”Adapting to the changing geopolitical landscape

EE Times asked Hanebeck about how companies such as Infineon manage the business objective of maintaining revenues from markets such as China while grappling with the changing geopolitical landscape.

He was, like other CEOs we have spoken to about this, quite measured and pragmatic: “The world of semiconductors got more complex because of geopolitics. How do we adapt to this? Well, China is a lead market for e-mobility, for example, but we have to work alongside all the rules and laws.”

With key automotive markets being across the U.S., China, South Korea, Japan and Germany, Hanebeck said, “We have discovered the benefits of diversification.”

Also, with India promoting its semiconductor industry globally, we asked what he thought of what’s going on there. “There’s a notion in the industry that India will develop,” he said. “We already have 2,500 employees in R&D in India. So if the market develops in India, we are ready. My gut feeling is that this time, it can be real.” (The latter is a reference to many attempts by India over the last three decades to kickstart a chip economy wider than just design services—see “India’s Semiconductor Stars Align to Build Out Ecosystem.”)

Automotive and e-mobility perspectives

Hanebeck talked about some of the long-term trends and opportunities in the industry, indicating key areas such as automotive, renewables, powering AI and IoT.

On e-mobility, he acknowledged that while this may be seeing a bit of a slowdown in Western countries, it may only be temporary, but China is still witnessing growth. On the battery-electric-vehicle (BEV) slowdown due to various factors, from range and infrastructure to vehicle cost, he said, “Long-range plug-in hybrids are a good solution. The Chinese discovered this very early, and you see that in the southern part of China, there are more BEVs, while in the north [where climate and infrastructure can impact range] you see more plug-in hybrids.”

Powering AI, making compute sustainable

In the discussion about whether the AI compute trend is sustainable, Hanebeck says what most others are also saying: that edge AI is a key part of the solution. Infineon’s role in powering AI was highlighted by Gerald Deboy, a fellow at Infineon; and AI’s role in providing energy-efficiency gains in industrial applications was highlighted by Lisa Erdmann, managing director of Industrial Analytics, a company acquired by Infineon in 2022.

Deboy specifically highlighted the growth of projected electricity consumption by data centers, indicating it could rise to 7% of global electricity consumption by 2030, rising from 2% in 2023. According to the Boston Consulting Group, it projects that total data center power demand in the U.S. will increase by 15% to 20% annually, to reach 100–130 GW (800–1,050 TWh) by 2030. That’s the equivalent of the electricity used by about 100 million U.S. houses—about two-thirds of the total homes in the U.S.

Exploring power conversion’s role in this, Deboy provided an outlook into future rack architectures and concluded that training large language models for AI with trillions of parameters will pose massive challenges for data centers. They’ll need new solutions in all power conversion stages along the entire power flow.

Don’t forget 300-mm GaN

While the day at Infineon explored many other aspects of powering AI, both in data centers and automotive battery management systems, as well as the important topic of cybersecurity in AI, we can’t close this story without the excitement that White exudes when talking about the breakthrough of 300-mm GaN wafers. After his presentation to the trade media, he said he was jetting straight to Silicon Valley, where customers are “already pulling on us to understand what this can do in terms of impact for AI.”

He emphasized that fully scaled 300-mm GaN production would contribute to GaN cost parity with silicon at RDS(on) level and that this would yield 2.3× as many chips per wafer compared with 200 mm.

When asked about capacity, White said this will scale as a function of demand. He said the company expects samples toward the end of 2024 and commercial production probably in 2026.

EE Times asked about whether the GaN Systems acquisition was a major contributor to the technology breakthrough. “GaN Systems enables expansion of our application capability and roadmap,” White said. “It’s been a successful integration and given us more confidence in bringing 300 mm into the market.”

CEO Hanebeck backed this up: “The GaN Systems acquisition worked well and was extremely helpful in terms of competence. We are determined to lead the market here in GaN.”